SPC announces the discovery of recoverable unconventional oil resources estimated at 22bn stock tank barrels

Abu Dhabi’s Supreme Petroleum Council (SPC) announced the discovery of substantial recoverable unconventional oil resources located onshore, estimated at 22bn stock tank barrels (STB), and an increase in conventional oil reserves of 2bn STB in the Emirate (Abu Dhabi).

The announcements were made following the recent SPC meeting presided over by HH Sheikh Mohamed Bin Zayed Al Nahyan, Crown Prince of Abu Dhabi and Deputy Supreme Commander of the United Arab Emirates (UAE) Armed Forces and Vice-Chairman, SPC.

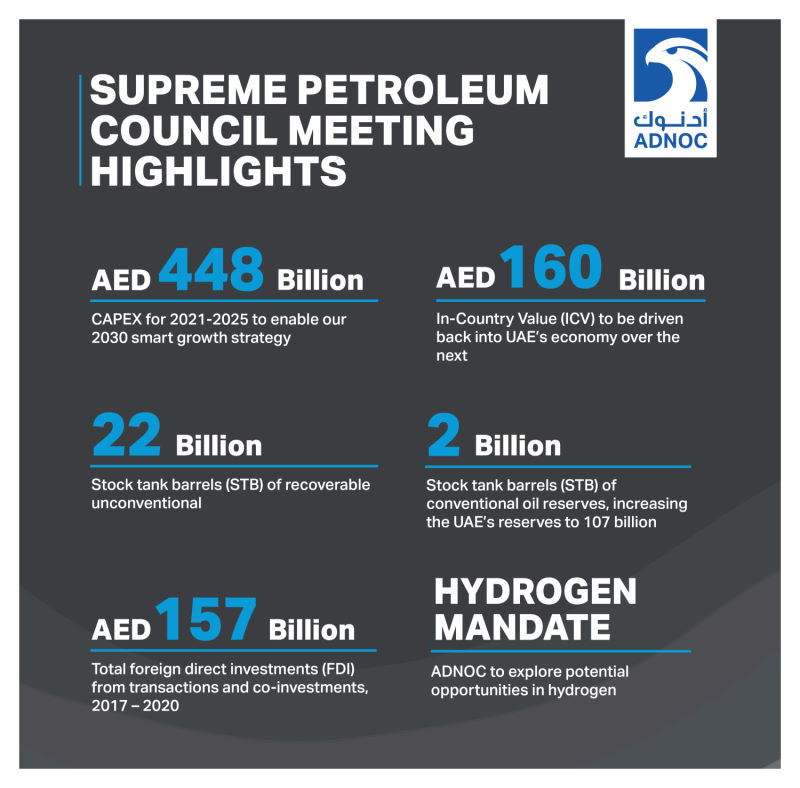

At the meeting, the SPC approved ADNOC’s capital expenditure (CAPEX) plan of AED 448bn (US$ 122bn) for 2021-2025 to enable smart growth. As part of this plan, ADNOC aims to drive over AED160bn (US$ 43.6bn) back into the United Arab Emirates’ (UAE) economy between 2021 and 2025.

The inflow to the local economy will be enabled by ADNOC’s In-Country Value (ICV) Programme which is aimed at nurturing new local and international partnerships and business opportunities for the private sector, fostering socio-economic growth and creating job opportunities for Emiratis.

Green light

In addition, the SPC gave approval for ADNOC to award exploration blocks in Abu Dhabi’s second competitive block bid round which was launched in 2019, it was revealed via a press communiqué.

The SPC also reviewed the transformation in ADNOC’s Marketing, Supply and Trading (MS&T) Directorate, which has evolved to offer customers a broader service, while further stretching the value from every barrel that ADNOC produces, refines and sells. The directorate has become a more integrated shipping and logistics, storage and trading focused entity, establishing two new trading companies – ADNOC Trading (AT) and ADNOC Global Trading (AGT) – to help deliver its mandate.

The SPC also reviewed ADNOC and ADQ’s recently announced joint venture, TA’ZIZ, established to fund and develop chemicals projects within the Ruwais Derivatives Park. ADNOC and ADQ, through TA’ZIZ, are setting the stage for the UAE’s next generation of technology-driven growth and helping to advance the UAE post-Covid economic recovery.

Commenting on ADNOC’s discovery of onshore unconventional oil resources and an increase in its conventional oil reserves, HH Sheikh Mohamed Bin Zayed said the achievement is a testament to ADNOC’s relentless efforts to unlock and maximize value from the UAE’s hydrocarbon reserves for the benefit of the nation.

“Following the SPC’s approval of ADNOC’s CAPEX, we are well-positioned to continue driving long-term and sustainable value for the UAE while creating opportunities for local businesses and private-sector jobs for Emiratis through our in-country value target,” affirmed HE Dr. Sultan Ahmed Al Jaber, UAE Minister of Industry and Advanced Technology and ADNOC Group CEO.

ADNOC’s CAPEX plan will enable it to drive upstream growth, progress downstream expansion and further strengthen the company’s marketing and trading capabilities to ensure it maintains its competitiveness and industry leadership position over the next fifty years.

Downstream expansion

ADNOC’s downstream expansion continues to prioritize the transformation of Ruwais into a globally competitive chemicals and industrial hub, leveraging close geographic proximity to fast-growing global demand centres, a competitive feedstock position, Abu Dhabi’s attractive fiscal and regulatory environment, and an integrated utilities, infrastructure and services offer to drive accelerated FDI inflows over the long term.

Despite the challenging market conditions, ADNOC delivered AED 62bn ($16.8bn) in foreign direct investment (FDI) to the UAE this year, taking the total FDI ADNOC has driven since 2016 to AED 237bn (US$ 64.5bn).

HH Sheikh Mohammed expressed the SPC’s appreciation of ADNOC’s smart and innovative approach to strategic partnerships and investments which has resulted in the company completing several landmark transactions.

ADNOC maintains its leadership role in driving ICV for the UAE following the huge success of its ICV program which has driven more than AED 76bn ($20.7bn) back into the UAE’s economy and created over 2,000 private-sector jobs for Emiratis since it was launched in January 2018. ADNOC’s new ICV goal will enable the localization of strategically critical parts of the oil and gas value chain and create more private-sector jobs for Emiratis.

The new discovered resources will further strengthen the UAE’s role as a leading resource holder with high-quality crude grades, reinforce the country’s energy security and underpin its position as an essential and reliable energy provider to the world. This year, ADNOC successfully increased its crude oil production capacity to over 4mn barrels per day (mmbpd).

Hydrogen opportunities

The mandate to explore potential opportunities in Hydrogen will see ADNOC capitalize on the emerging global market for Hydrogen by leveraging its existing infrastructure and partnership base as well as Abu Dhabi’s vast reserves of natural gas.

ADNOC already produces hydrogen for its downstream operations and following this mandate, the company will explore the potential to help meet the emerging global demand for hydrogen and ammonia derived from natural gas.

Building on its advantaged position as a major natural gas reserves holder and producer, with existing infrastructure and strong partnerships, ADNOC is well placed to lead the development of international value chains and establish a hydrogen ecosystem for the UAE in partnership with other Abu Dhabi entities.

Recoverable oil resources

The 22bn STB of recoverable unconventional oil resources announced by the SPC exceeds some of Abu Dhabi’s major fields in terms of resources and the production potential ranks alongside the most prolific North American shale oil plays. The unconventional oil resource assessment was supported by extensive well data as well as a dedicated appraisal program by ADNOC in an area covering 25,000sqm in Abu Dhabi.

The 2bn STB of conventional oil reserves announced by the SPC increases the UAE’s conventional oil reserves base to 107bn STB of recoverable oil, strengthening the country’s position in global rankings as the holder of the sixth-largest oil reserves.

This increase in reserves is as a result of the ongoing maturation of ADNOC’s developments towards its 5mn barrels per day (mmbpd) oil production capacity target by 2030, and its appraisal activities, particularly in the Al Nouf field.

Both the conventional and unconventional oil resources offer the potential to provide ADNOC with additional amounts of Murban-grade crude. Murban is ADNOC’s signature grade crude and is recognized around the world for its intrinsic chemical qualities, consistent and stable production volumes, large number of international buyers, and numerous long-term concession and production partners.

Hydrocarbons

These additions to the UAE’s hydrocarbons base follows the announcement in November 2019 by the SPC of increases in hydrocarbon reserves of 7bn STB of oil, 58tn standard cubic feet (TSCF) of conventional gas, and 160 TSCF of unconventional recoverable gas resources.

These additions to the UAE’s hydrocarbon reserves marked a historic milestone for the country since the last major update of its reserves base three decades ago.

As ADNOC develops its upstream resources and expands its downstream footprint, it is further strengthening its marketing and trading capabilities. As part of this effort, AGT – a joint venture with ENI and OMV – is set to begin the trading of refined products before the end of the year.

In addition, ADNOC will expand its shipping capabilities by purchasing a fleet of Very Large Crude Carriers (VLCCs), through ADNOC Logistics & Services (ADNOC L&S), creating new long-term revenue streams as it enters a new sector to support growing customer demand and its historic move into trading.